APAC Technology: is there Light at the End of the Tunnel?

- Due to various macro and micro issues (US-China trade war, US fed aggressive rate hike, sluggish IT demand, Intel CPU shortage), there has been a slowdown in demand from 2H18

- Despite the current short-term downward pressure, current valuation multiples are near the global financial crisis level in 2008 and we see several reasons to be optimistic about a potential turnaround in the tech sector momentum during the 2H19F

- There are a number of new technologies we can expect in 2019F (5G, autonomous vehicles, IoT, new enterprise platforms) that we see favorable in our tech universe

Macro in 2019: 2016 déjà vu?

Following a late 2H15-1H16 macro soft patch i.e. taper tantrum, the global tech market underwent an inflationary bull market through 1H18. However, due to various macro and micro issues, there has been a slowdown in demand from 2H18, with higher chances of further downward pressure in 1H19. The US Fed raised the interest rate four times in 2018, which led to weakening emerging market currencies, interest rate hikes, and resulting in a slowdown in demand. The recent US-China trade friction also brought about abrupt supply chain disruption due to conservative management by companies. However, recent weakness from the micro data would be bad enough to change macro policy makers’ stance toward more stimulus policies and potentially signal a pause in US Fed rate hike. The current valuation multiple are lowering towards the levels seen during the global financial crisis in 2008.

2019: colder winter has come but with the hope of spring in H2

Despite the current short-term downward pressure, there are several reasons to be optimistic about a potential turnaround in the tech sector momentum during the second half of 2019, some of which include:

- A high possibility of a slowdown in interest rate hikes by the US Fed and/or an economic stimulus package by China in 1H19F

- Component players in oversupply are adjusting capex proactively

- Likely replenishment demand by set makers after aggressive inventory adjustment

- Introduction of 5G service in 2019

- Easing of Intel CPU shortage issue from 2Q19

- Expected launch of new platforms by intel and AMD in 1Q19 for hyper-scale servers

- Secular growth around other mega-trends related to the 4th Industrial Revolution (4IR) i.e. AI, autonomous driving, Internet of Things (IoT)

New technology on the rise

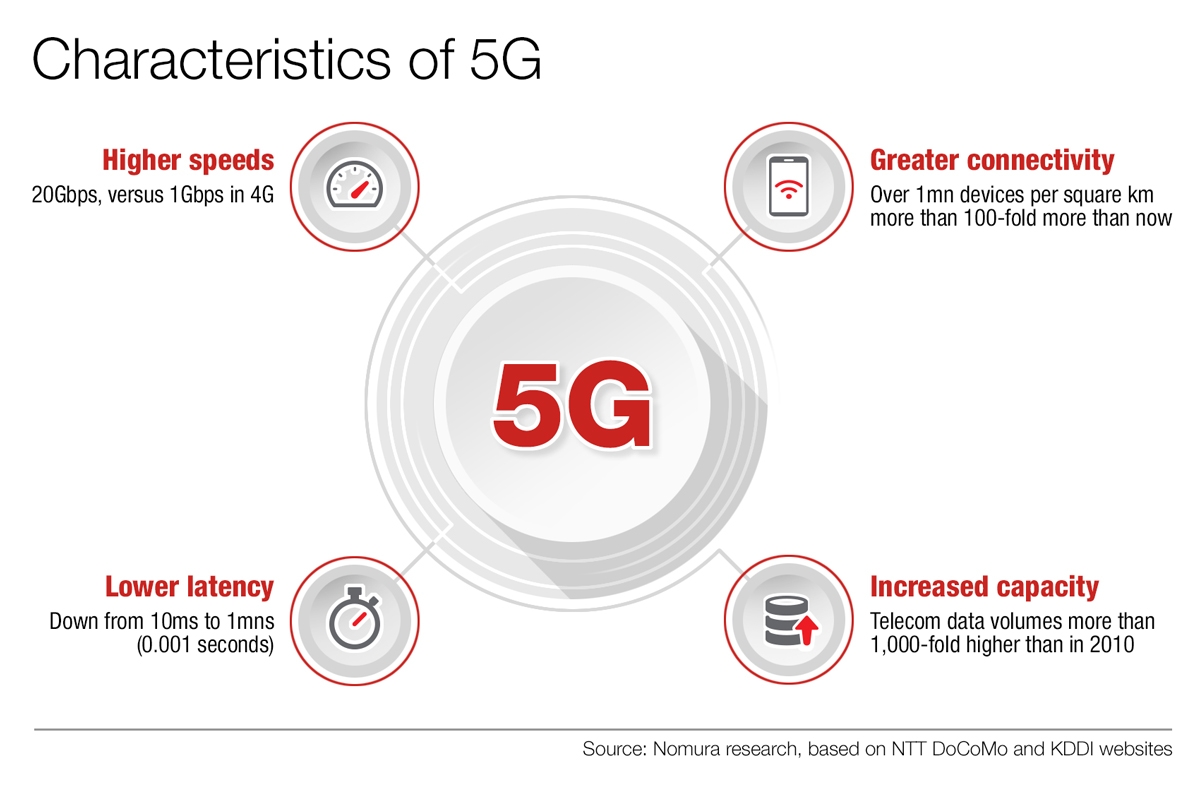

1) 5G: introduced in 2019 and to be mainstream in 2020F onwards

5G will be introduced in 2019, six years after the implementation of 4G in 2013. Similar to its predecessor, 5G’s commercialization will be established by Korean telecom companies, followed by the Chinese, and commercializing service in 4Q19. Both Chinese and Korean telcos are likely to reintroduce a subsidy for smartphones to increase 5G penetration. Korea, China, the US and Japan are expected to fully support 5G service by 2020.

2) Commercialization of autonomous driving taxis

On December 5, 2018, Google unveiled a driverless taxi service, Waymo One, in Phoenix, Arizona. While Waymo still requires drivers behind the steering wheel, it is capable of Level 4 autonomous driving which comes close to full autonomous driving, which allows the vehicle to drive under limited conditions and will only operate when all required conditions are met. The core hardware items for autonomous driving are processors, memory and 5G network equipment for edge-computing, with Lidar and camera sensors as well.

3) The fall of cryptocurrency but 4th industrial revolution trend is intact and will arrive much faster than market expectation

Due to recent weakness in the cryptocurrency market, the mining hardware market has collapsed, which has hit NVidia’s share price. In addition, AI companies have started to use efficient proprietary ASIC to develop AI, which is also posing a threat to the related hardware market (memory, CPU, GPU). Although development of efficient AI development tools may threaten certain hardware companies in the short term, it will expedite the arrival of the AI generation at a much lower cost.

IoT is also a key part of 4IR, which involves the digitalization of analogue signals and inputs everyday items. While we were cautious on the IoT trend during its early stages 2-3 years ago (due to the lack of infrastructure and hardware), we now see increasingly feasibility of IoT uses, thanks to fast improvement in necessary hardware tech including upcoming 5G networks, and the use of AI to collate vast analogue signals (i.e., video, audio, pressure signals). With continuous collection/analysis of ever-abundant data, we expect the steep growth of IoT businesses to continue.

Intel is also making meaningful progress in IoT business, commercializing the latter’s technology in areas such as industrial, smart city, retail and healthcare applications. IoT growth should accelerate and start to have a direct impact on jobs which could be replaced by IoT and AI.

4) New enterprise platforms from Intel and AMD

Intel Xeon Roadmap: Intel announced two new processors in its Xeon portfolio including the 48-core Cascade Lake advanced performance processor, which is a major upgrade on current Xeon chips. While it is designed for the most demanding high-performance computing, AI and IaaS workloads, it mainly enhances hardware security, mitigating against side-channels attacks through partitioning.

We expect Intel and AMD’s new platform to induce demand rapidly from hyper-scale companies and bring positive changes to memory companies and the related component supply chain, due to: 1) the doubling of memory capacity compared to the current platform; 2) improvements in system performance by improving electricity efficiency by 30% and solving security issues.

What else does 2019 have in store in the technology space? Find out sector and company outlooks here.

Contributor

CW Chung

Head of Research, Korea and Pan-Asia Tech / Semiconductors Research

Masaya Yamasaki

Industrial Electronics, Japan

Tetsuya Wadaki

Semiconductor Production Equipment & Precision Instruments, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.