NIFA featured article - Reaping the Big-Data Dividend: Why China Stands to Gain most from AI

Artificial Intelligence (AI) is predicted to add USD15.7 trillion to global GDP by 2030. While North America is expected to receive nearly a quarter of this windfall, China’s economy will account for USD7 trillion, positioning it as a prime beneficiary of the AI boom.

This disparity comes down to Chinese enterprises benefiting from “perhaps the world’s richest array of data sources,” explained Azeem Azhar, founder of Exponential View, speaking at the 2019 Nomura Investment Forum Asia in Singapore.

The “AI lock-in loop”

Data lies at the heart of a virtuous cycle whereby machine learning fed by data powers the development of better products, which in turn promote greater usage and the generation of even more data, leading to products of greater quality and refinement. Azhar dubs this process the “AI lock-in loop.”

This loop confers a considerable strategic advantage to the world's dominant repositories of consumer data – the GAFA grouping of Google, Amazon, Facebook and Apple in the US, and China's tech triumvirate of Baidu, Alibaba and Tencent, or BAT.

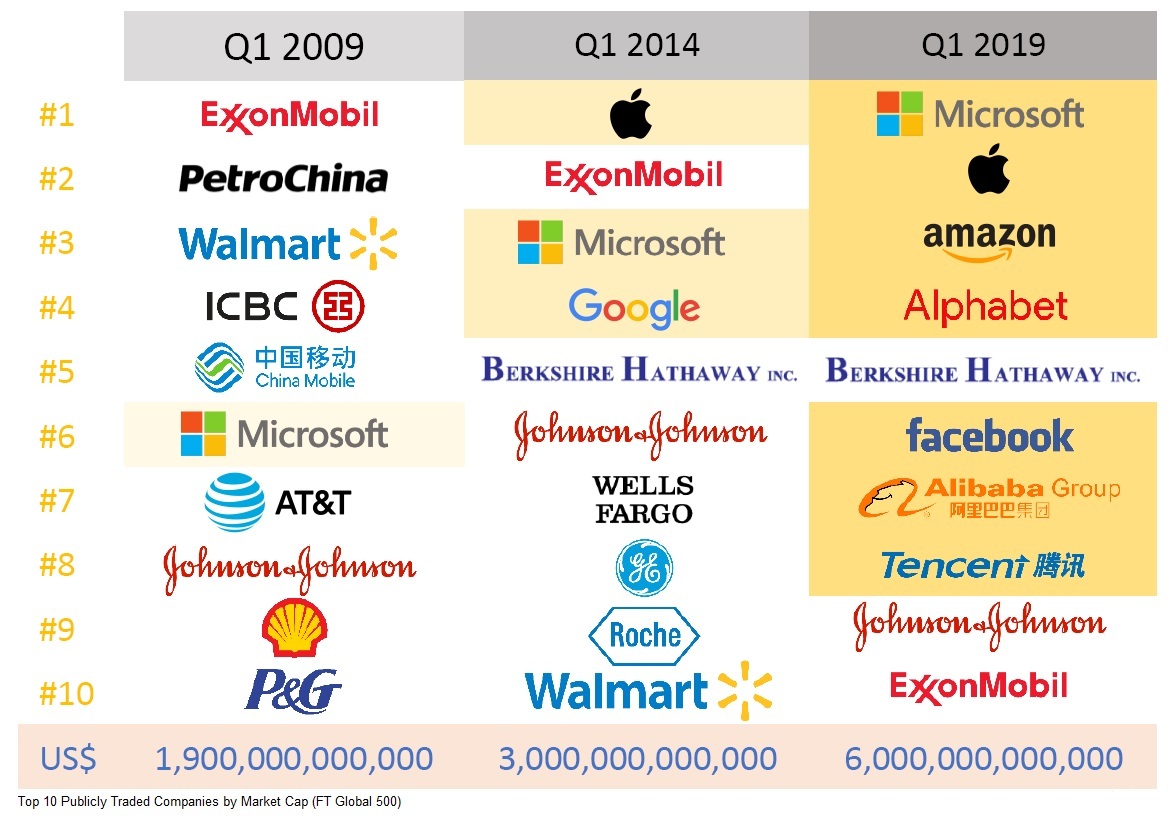

Data dominance effectively creates economic moats thwarting new entrants, and on the back of AI’s promise, these companies are now among the most valuable in the world. A glance at the change in the composition of top ten companies by market capitalization over the past decade shows a clear transition from industrial-era to AI-era firms, observed Azhar, a strategist, analyst, product entrepreneur and writer who disseminates his ideas through the influential Exponential View newsletter.

Notably, the combined valuation of the AI-era top ten is worth more than three times as much as the industrial-era top ten was worth in 2009, reflecting the market's expectations of the technology giants’ robust earnings potential.

China’s data goldmine

BAT’s ability to exploit data is bolstered by a variety of factors, not least of which is demographics – China’s internet users now number 829 million, more than double the entire population of the US. Importantly, technological adoption is extremely rapid in China, with mobile payments and the use of all-pervading “super apps” such as WeChat now ubiquitous.

China’s tech giants, particularly Alibaba and Tencent, have become repositories of consumer data of unparalleled breadth owing to their proclivity to continually extend their reach - from their core ecommerce and messaging offerings to a dizzying range of sectors, from entertainment and mobility to healthcare and wealth management. It’s not for nothing that founder Jack Ma describes Alibaba as an “everything company.”

As Azhar pointed out, “China creates much more data in absolute volumes in much more heterogenous environments, which creates really great data sets to build AI systems from.” He added that China’s AI progress is also fast-tracked by a “flexible approach to how consumer data can be shared across organisations,” in contrast to the more onerous data regulation and privacy requirements in Western markets.

There’s more than data behind China’s edge in AI, however. “China also has a very fierce entrepreneurial culture underlying not just the big two or three platforms we think about but many others as well,” noted Azhar. “There’s also an engineering mindset that has Chinese companies taking these technologies and implementing them very quickly. They can scale these things industrially very well.”

The binding glue of future tech

In addition to AI, other emerging technology platforms that will over time each be worth many trillions of dollars, according to Azhar, are: robotics; space technology; synthetic biology and genomics; and, renewables and their chemistry. But AI holds a special place because it is a general-purpose technology that serves as “a blinding glue that connects each of the other platforms.”

The effective development and operation of everything from drones and autonomous vehicles to genomic sequencing and renewable energy storage would simply not be practical without AI.

More broadly, AI is seen creating tremendous value in all traditional industries, covering every sector and business activity and redefining boundaries. Indeed, at Nomura too AI has been deployed to aid the process of digital transformation and the creation of new products and services.

“There isn't an industry where AI hasn’t become one of the top priorities or where there aren't immediate use cases for AI,” noted Azhar.

With Chinese companies having surged ahead of their US counterparts in AI-related patent filings over the past three years, there’s a good chance China will continue to close the gap with the US across a variety of sectors, especially in strategically important high-tech activities.

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.