Economics

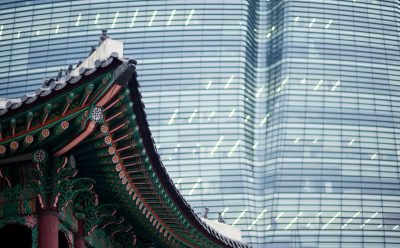

Equity Markets in 2019: Soft Power Matters

As we approach 2019, we see a slowdown in economic growth rates across the region, but we can also expect some structural changes in the way investors view Asia, such as the China market. Traditionally, investors have looked at China in the context of Asia ex-Japan. However, our projections suggest China will be the biggest component of Asia-Pacific, superseding Japan as the biggest market in the region by 2023. Jim McCafferty, Head of Equity Research AEJ, talks about the forecast of the equity markets in 2019.

2 min video | December 2018