Economics | 4 min read September 2017

Economics | 3 min read | September 2017

Economics | 3 min read | September 2017

Need to add blockIntro

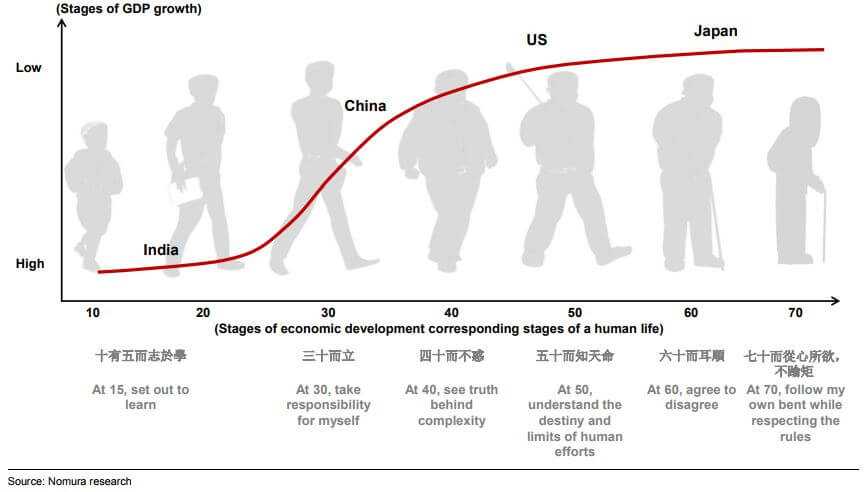

The life cycle of four equity pools – India, China, the US and Japan

The well-known philosopher in China, Confucius, said: “at 15, I set out to learn; at 30, I take responsibility for myself; at 40, I see truth behind complexity; at 50, I understand destiny and limits of human efforts; at 60, I agree to disagree; at 70, I follow my own bent while respecting the rules” (子曰:「吾十有五而志於學,三十而立,四十而不惑,五十而知天命,六十而耳順,七十而從心所欲,不踰矩。」).

It appears that the listed equity sample for India is much like a young adult. Starting from a low base, top-line growth is fast, and the outlook on future growth is undoubtedly bright. On the other hand, the listed equity sample for China is much like an established individual looking to move further uphill. This brings bigger challenges at home and abroad, and the key attribute is fast learning and adaption to change. Meanwhile, the US listed equity sample is like an individual at the top of the fame. It has the most well-rounded capabilities and achievements. But some incremental developments, such as seeking short term gains to investors over compensations to employees, are less favorable and also show that its large domestic market has yet to revive. Where as in Japan, the listed equity sample is like a grown-up who has been through ups and downs, and is now seeking understated excellence through growing businesses overseas to offset an aging population at home.

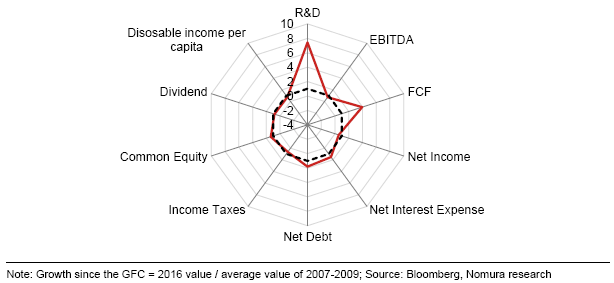

Five features for Chinese equities shown in the comparative study

Read the full report here for detailed comparative study on China’s equity strategy.

Greater China Equity Strategist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Economics | 4 min read September 2017

Economics | 3 min read August 2017

Technology | 4 min read May 2017