Economics | 4 min video July 2018

Economics | 2 min read | August 2018

Economics | 2 min read | August 2018

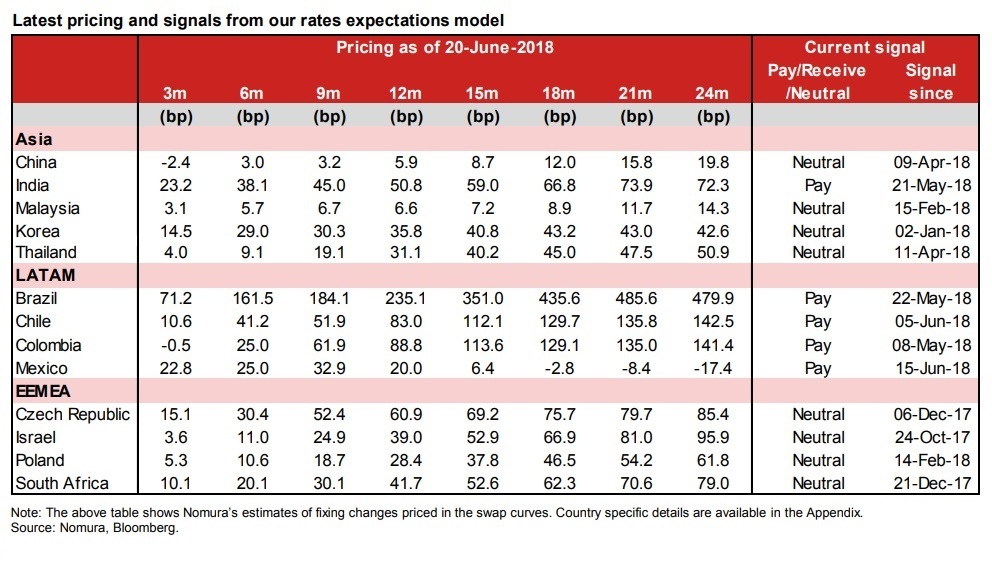

When deciphering EM rates, we look at 14 rate markets across Asia, Latin America (LatAm) and EEMEA, and highlight the evolution of benchmark policy rates and analyze their relationship with IRS/CCS fixings through different monetary policy regimes by looking at seasonal factors and possible leads or lags in the fixing to potential rate actions. We also look at the effects of sharp domestic equity and foreign exchange (FX) moves on the fixing.

From this analysis of EM rates markets, IRS/CCS fixings are observed to broadly track benchmark policy rates, but there are factors – mainly seen in Asia rates markets – that could create occasional divergences.

While relationships between the fixing and policy rates during rate cuts, hikes and neutral monetary policy regimes vary, there are noticeable patterns in Asia. In LatAm and EEMEA, we have observed broad stability in the fixing and policy rate spreads, with most divergences temporary and driven by significant market volatility and/or seasonal factors such as tax payment periods and popular holidays.

Regarding potential rate hikes and cuts, the fixings broadly move on the day the rates action is delivered but there is some evidence – in Korea, Thailand, Czech Republic, Israel, Poland and South Africa – that fixings can start moving lower or higher into the rate cut or hike event. In addition, we tested the predictive power of our model and found that momentum strategies (pay rates when markets are pricing in hikes, receive when markets pricing in cuts) perform better than mean reversion strategies. There is also evidence that central banks tend to meet market expectations at policy meetings.

Other factors affecting the fixing are local equity/FX moves, independent of policy expectations. For instance, a 4% move in equity markets could influence fixings in China, Korea, Colombia and Mexico. However, in EEMEA, significant, negative equity/FX moves had broader impacts on fixings.

Finally, when testing the relevance of the rates expectation models in key markets such as China, India, Korea, Chile, Mexico, Czech Republic and South Africa, it was found that our model is broadly able to predict the direction of 1Y swap rates with a three-month lead, independent of the US Fed cycle.

Overall, the momentum strategy worked best in Malaysia, Korea, South Africa, and Chile. In India, Czech Republic and to an extent China, momentum strategies performed better for receivers while, in Mexico and South Africa, the most profitable/reliable signals were for higher rates and payers. One exception is Israel, where a mean-reversion strategy performed slightly better than a momentum strategy.

For more insights on deciphering EM rate expectations, read here.

Global Head of FX Strategy

Strategist, LatAm FX/rates

Senior EM Strategist

Asia Rates Strategist

Asia Rates Strategist

Strategist, Asia ex-Japan

Fixed Income Research

EM Rates and FX Strategy

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Economics | 4 min video July 2018

Emerging Markets | 2 min read June 2018

Emerging Markets | 3 min read April 2018